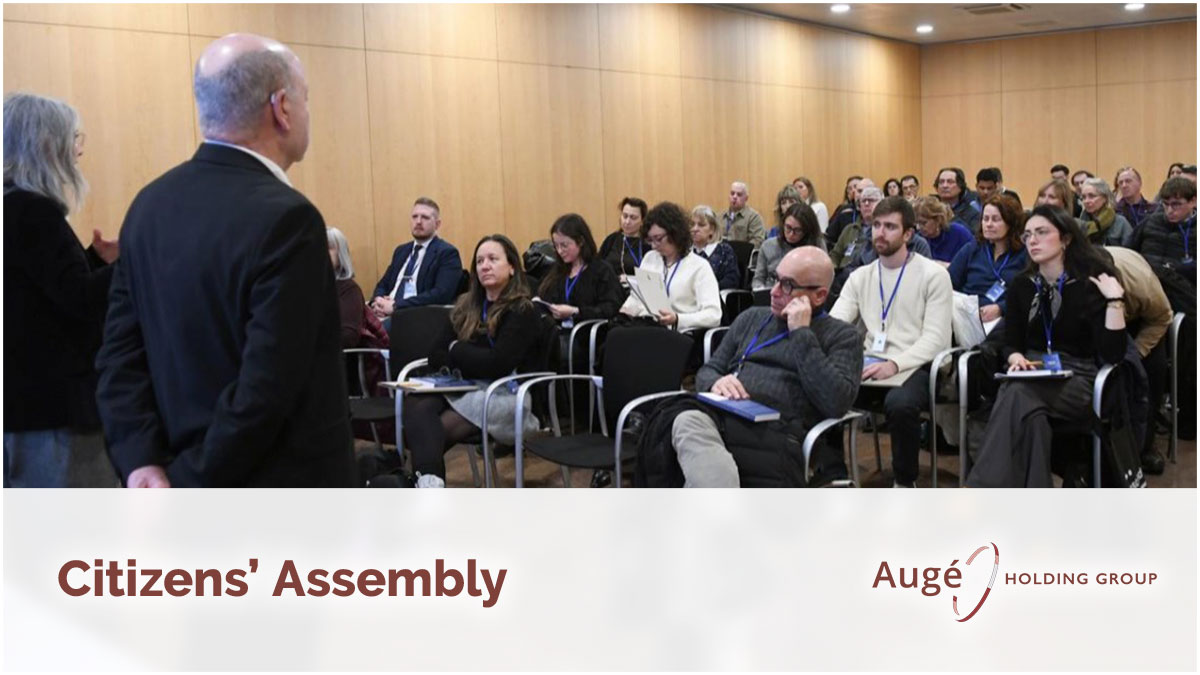

Citizens’ Assembly: empowerment and real democracy or participatory theatre?

A year ago, at Christmas, within our professional group we expressed a very specific wish for this 2025 that we have now left behind: that

Sharing the values of the group, at Augé Holding Group, we consider the customer as the undisputed protagonist and the main beneficiary of all our effort and dedication. Due to the different services and practice areas in which we expertise, this translates into an agile and effective response to any question that may arise. We consider our service as synonymous with a 360º solution.

Subsidiaries

Years of experience

Satisfied clients

Results under the advisory

Subsidiaries

Years of experience

Satisfied clients

Results under the advisory

Do you want to contact one of our professionals?

Do you want to know what are the advantages of living in Andorra? Would you like to study the possibility of establishing your business in Andorra? Is full tax optimization your top priority? Do you consider studying the requirements that you must meet to reside in Andorra? Our professionals will be able to develop a specific analysis of your case, carrying out optimal planning focused on your business and life in Andorra. Our 360º service model offers everything you need from the start to settle and reside in our country.

Our firm integrates lawyers specialized in all branches of law, tax advisers, consultants in the field of immigration, in matters of banking compliance and intellectual property.

A year ago, at Christmas, within our professional group we expressed a very specific wish for this 2025 that we have now left behind: that

When a client moves to Andorra, there is a simple but decisive step: deregistering in the country of origin and completing the registration in Andorra.

International double taxation arises when two different countries seek to tax the same income. A typical example is a company resident in one State that

Talk to our team

Do you want to contact one of our professionals?